Sandfire and White Rock Enter JV Agreement for the Red Mountain Zinc Project, Alaska

MinesOnline.com Reviews Sandfire’s Proposed JV with White Rock for the Red Mountain Project

On 10 July 2018, White Rock Minerals Ltd. (White Rock) announced1 it has agreed to grant Sandfire Resources NL (Sandfire) the option to enter a joint venture (JV) with relation to the Red Mountain Zinc Project (the Project) located in Alaska, 100km south of Fairbanks. This option may be exercised prior to 31 December 2018.

If Sandfire exercises its option to enter the JV, Sandfire will incur upwards of A$30M in exploration expenditure to acquire up to 90% of the Project, which has JORC 2012 compliant Mineral Resources of 16.7Mt @ 8.8% ZnEq. MinesOnline.com has therefore attributed the Project Exploration status.

The JV will consist of four stages: Stage 1 requires Sandfire to fund A$20M of exploration expenditure over four years to earn 51%, Stage 2 requires Sandfire to fund a further A$10M of exploration expenditure and complete a Preliminary Feasibility Study over an additional two years to earn 70%, Stage 3 grants White Rock the option to contribute to the JV, if not, Sandfire will fund the completion of a Definitive Feasibility Study to earn 80% and Stage 4 grants White Rock the option to contribute to the JV, if not, Sandfire will earn 90%.

This agreement forms part of a broader strategic agreement relating to the Project between White Rock and Sandfire, which also includes the creation of a joint technical committee for the Project and an equity placement. Under the terms of the placement, Sandfire will pay A$2.5M in exchange for 208M shares and 104M options, a 41% premium to the one-month White Rock VWAP. Upon completion of the placement, Sandfire will own ~14.2% of White Rock. This placement is not conditional on the JV, and is therefore excluded from MinesOnline.com’s transaction metric calculations below.

This transaction comes as Sandfire proposes to acquire the remaining 30% of its 70% owned Springfield copper JV from Talisman Mining Ltd. for A$70M, covered in MinesOnline.com’s previous newsletter dated 11 June 2018.

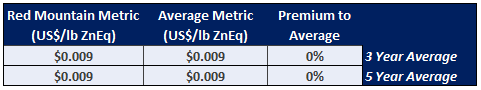

Transaction Market Metrics Comparison

Given the uncertain value attibuted to the Red Mountain JV expenditure from Stage 2 onwards, including the requirement to complete a PFS, MinesOnline.com has applied the Stage 1 expenditure of A$20m (to earn 51% of the Project) to the Project’s current Mineral Resource of 16.7Mt @ 8.8% ZnEq to derive an estimate of the implied Project value. On this basis, the transaction occurred at US$0.009/lb ZnEq, which is consistent with MinesOnline.com’s 3 and 5 year normalised average Exploration multiples.

Normalised Average Multiples2

1 See White Rock’s announcement here

2 Average Resource metrics normalised using 30 June 2018 Zinc price of US$1.32/lb.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.