MinesOnline.com Reviews Sandfire’s Acquisition of the MATSA Mining Complex

- A$1,248M (US$905M) fully underwritten equity raising, in which A$120M (US$88M) will be placed to Australian Super, A$165M (US$120M) to institutions and A$963M (US$697M) to eligible institutional and retail investors through an equity raising;

- A$897 (US$650M) syndicated and underwritten debt facility secured against MATSA;

- A$200M (US$145M) corporate debt facility secured against Sandfire’s DeGrussa operation; and

- A$297M (US$215M) funded through Sandfire’s existing cash reserves

(collectively the Transaction Consideration).

MinesOnline.com notes that the total consideration above includes an additional A$69M (US$50M) to cover transaction costs.

The transaction is expected to complete in the March 2022 quarter, with key conditions precedent including Spanish Foreign Direct Investment and Anti-trust Merger approval.

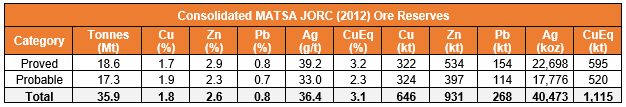

MATSA is a high quality, low cost, long life underground copper operation located in the well renowned lberian Pyrite Belt of Spain. The Project has a long history of production and is currently producing 104kt CuEq per annum, so MinesOnline.com has reviewed the Transaction using comparable Operation stage deals.

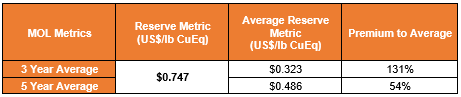

Based on the Transaction value of US$1,865M and a ~2,495Mlb CuEq Ore Reserve, Sandfire will pay US$0.747/lb CuEq, representing a premium of 131% and 54% to MinesOnline.com’s 3 and 5 year average Operation Multiples of US$0.323/lb CuEq and US$0.486/lb CuEq, respectively.

MinesOnline.com notes that the MATSA acquisition will add ~12 years to Sandfire’s production profile and will fill the gaps in production between its DeGrussa and Motheo operations. Additionally, the Transaction may be accretive to Sandfire’s existing operations, decreasing its C1 costs and increasing its annual production.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.