MinesOnline.com Reviews Polymetal’s Proposed Sale of the 0.77Moz Kapan Gold Mine

MinesOnline.com Reviews Polymetal’s Proposed Sale of the 0.77Moz Kapan Gold Mine, Armenia

On 30 October 2018, Polymetal International plc (Polymetal) (LSE:POLY) announced1 it has agreed to sell its wholly owned Kapan Gold Mine (Kapan or the Project) to Chaarat Gold Holdings Limited (Chaarat) (AIM:CGH) for total consideration of US$55.00M.

Under the terms of the transaction, Chaarat will pay Polymetal US$55.00M for the Project, subject to working capital and other customary adjustments, in the form of cash, with an option for Chaarat to elect to satisfy up to US$5.00M of the consideration in Chaarat’s 2021 Convertible Notes.

The Project is located in Kapan province, Armenia and hosts an Ore Reserve of 4.1Mt at 2.1g/t Au for 0.27Moz Au (0.57Moz AuEq)2 and a Mineral Resource of 8.4Mt at 2.9g/t Au for 0.77Moz Au (1.67Moz AuEq)2. Kapan has been producing since 2003, with current reserve life extending to 2023 and production in the 2017 calendar year of 50,000oz of gold equivalent.

Polymetal is divesting the Project as a part of its strategy to focus on large scale and long life operations, as the Project is the smallest and highest cost operation in Polymetal’s portfolio. Currently, Kapan has an AISC of US$1,292/oz, ~47% higher than Polymetal’s average AISC of US$877/oz. Kapan also represents 7% of Polymetal’s workforce, whilst representing 3% of Polymetal’s production, Ore Reserves and adjusted EBITDA.

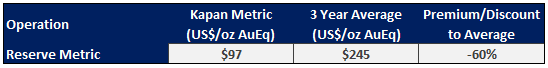

Transaction Market Metrics Comparison

Normalised Average Multiples3

As Kapan has been producing gold since 2003, MinesOnline.com has attributed the Project Operational status, for which the preferred metric is a Reserve metric. On a Reserve basis, Kapan transacted at US$97/oz, a discount of 60% to MinesOnline.com’s 3 year normalised average of US$245/oz.

MinesOnline.com notes that, as mentioned above, the Project represents a comparatively high cost, small scale, non-core asset for Polymetal, which would explain part of the high discount observed. In addition to this, the Project is located close to Armenia’s border with Azerbaijan, a source of ongoing conflict between the two nations and a potential source of security risk (Control Risks Inc rates security risk of Armenia’s border with Azerbaijan as high), which provides a further explanation for part of the discount observed.

1 See Polymetal’s announcement here.

2 Gold equivalent calculated using 29 October 2018 gold, copper, silver and zinc prices.

3 Average metrics normalised using 30 September 2018 gold price of US$1,191/oz.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.