MinesOnline.com Reviews Newcrest’s Proposed Sale of the Séguéla Gold Project, Côte d’Ivoire

MinesOnline.com Reviews Newcrest’s Proposed Sale of the Séguéla Gold Project, Côte d’Ivoire

On 12 February 2019, Newcrest Mining Limited (Newcrest or the Company) (ASX:NCM) announced1 it has agreed to sell a portfolio of exploration tenements in Côte d’Ivoire (the Project), including its Séguéla Gold Project (Séguéla), to Roxgold Inc. (Roxgold) (TSX:ROXG) for total consideration of US$30.0M.

Roxgold will pay total consideration of US$30.0M in cash for the Project, comprising US$20.0M cash on completion and a US$10.0M deferred cash payment contingent on first gold production from the Project. This transaction is subject to conditions precedent, including approval from the Minister of Mines of Côte d’Ivoire and the renewal of the Séguéla exploration permit.

The Project comprises 11 exploration permits covering 3,298km2 with significant scope to build upon existing data and high quality exploration work completed to date. The Project includes Séguéla, a gold project located in the Woroba District, ~220km northwest of Yamoussoukro, Côte d’Ivoire, with a JORC 2012 compliant Mineral Resource of 5.8Mt at 2.3g/t Au for 430koz Au.

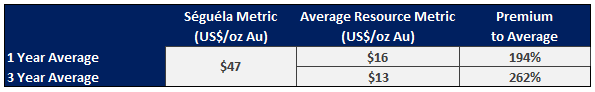

Transaction Market Metrics Comparison

Normalised Average Multiples2

As the Project has a defined Mineral Resource but no completed feasibility studies, MinesOnline.com has attributed the Project Exploration status. On a Resource basis, the Project transacted at US$47/oz, a premium of 262% to MinesOnline.com’s 3 year normalised average of US$13/oz and a premium of 194% to MinesOnline.com’s 1 year normalised average metric of US$16/oz.

MinesOnline.com believes this premium clearly demonstrates the value that Roxgold has placed in the Project beyond the Mineral Resource at Séguéla, as the Project would provide Roxgold with a key second asset in West Africa (its flagship asset being the high-grade +1Moz Yaramoko Gold Mine located in Burkina Faso), a large, carefully assembled prospective land package with substantial near-term exploration upside at both its early stage and advance stage exploration tenements and previously completed high quality exploration work at the Project.

MinesOnline.com notes that the Project has had significant drilling and exploration work completed across its 11 tenements with ~US$21.0M spent on exploration and ~117km of drilling completed at the Project to date, however of the tenements comprising the Project, only Séguéla has a defined Mineral Resource. In estimating the Séguéla Mineral Resource, Newcrest used a 0.5g/t Au cut-off grade based on the assumption of conventional open-pit mining and CIL processing, using a gold price of US$1,300 per ounce, a notional spatial constraining pit shell based on a gold price of US$1,400 per ounce and a 0.80 AUD/USD exchange rate. While the Resource is only classified as inferred, the economic parameters used indicate that the Resource has significant potential and that this, together with the Project’s significant exploration potential, could explain the transaction’s substantial premium to the 1 and 3 year normalised average metrics.

1 See Newcrest’s announcement here and Roxgold’s announcement here.

2 Average Reserve and Resource metrics normalised using 31 January 2019 gold price of US$1,323/oz.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.